How the October 2021 budget may affect your business or personal finances

The Chancellor, Rishi Sunak, presented his Autumn 2021 Budget and Spending Review on 27 October 2021.

Before taking any action based on the contents of this update, please contact us to discuss what the Budget announcements will mean for you and that consider your unique business or personal financial circumstances.

Impact on your personal taxes or finances

Income tax rates and allowances for 2022/23

As announced at the March 2021 Budget, the personal allowance will remain at its 2021/22 level of £12,570 for 2022/23, with the allowance being reduced by £1 for every £2 by which income exceeds £100,000. This means that if your income is more than £125,140 you will not receive a personal allowance for 2022/23. You may wish to consider making pension contributions or gift aid donations to preserve your personal allowance and avoid paying tax at the high marginal rate of 60% that applies on income between £100,000 and £125,140.

The rates of income tax remain unchanged, with the basic rate staying at 20%, the higher rate at 40% and the additional rate at 45%. The basic rate band remains at £37,700. The additional rate of 45% will continue to apply to taxable income more than £150,000.

The freezing of the thresholds may mean that if your income keeps pace with inflation, you may move into a higher tax band and pay tax at a higher marginal rate.

The married couple’s allowance, available where at least one spouse or civil partner was born before 6 April 1935, is increased to £9,415. The income limit, above which the allowance is reduced by £1 for every £2 by which income exceeds the limit until the minimum amount of the allowance is reached, is set at £31,400. The minimum amount of the married couple’s allowance increases to £3,640 for 2022/23.

The rates and thresholds applying in Scotland to the non-savings non-dividend income of Scottish taxpayers will be announced in the Scottish Budget on 9 December.

National Insurance increases

As part of the Government’s plan for health and social care funding, the rate of Class 1 and Class 4 National Insurance contributions are increased by 1.25% for 2022/23 only. This means that the main primary rate payable by employees will be 13.25% and the additional primary rate will be 3.25%, while the main rate of Class 4 contributions payable by the self-employed will be 9.25% and the additional Class 4 rate will be 3.25%. The rates payable by employers (secondary Class 1, Class 1A and Class 1B) are also increased by 1.25% for 2022/23, to 15.05%. The rates will revert to their 2021/22 levels from 6 April 2023 when the new Health and Social Care Levy comes into effect.

The upper earnings limit for primary Class 1 purposes (and the associated upper secondary thresholds) and the upper profits limit for Class 4 remain frozen at £967 per week (£4,189 per month, £50,270 per year) for 2022/23. The other thresholds are increased in line with inflation. As a result, the lower earnings limit increases to £123 per week, the primary threshold increases to £190 per week and the secondary threshold increases to £175 per week. A new secondary threshold for Freeport employees of £481 per week applies from 6 April 2022.

The increases in the National Insurance rates and changes to the thresholds will affect your take home pay. If you operate your business through a personal or family company, they will also impact on your profit extraction strategy.

We can help you determine your optimal salary level for 2022/23 and re-examine your remuneration strategy based on this and other budget changes.

The rate of Class 2 National Insurance, payable by the self-employed, is increased to £3.15 per week for 2022/23 and the small profits threshold rises to £6,725. The rate of voluntary Class 3 National Insurance contributions rises to £15.85 per week for 2022/23.

Health and Social Care Levy

A new levy, the Health and Social Care Levy, will apply from 6 April 2023. The funds raised for the levy will be ring fenced to meet health and adult social care costs. Payment of the levy is linked to earnings on which a qualifying National Insurance contribution is payable. This is a Class 1 (employee’s and employer’s) contribution, a Class 1A contribution, a Class 1B contribution and a Class 4 contribution. The levy is payable at the rate of 1.25% on the earnings on which a National Insurance contribution would be due.

However, unlike National Insurance contributions, an individual’s liability to pay the Health and Social Care Levy does not come to an end when the individual reaches state pension age.

Associated changes mean that from October 2023, a cap is introduced on the amount that an eligible person will have to contribute to the costs of personal care over their lifetime. This is to be set at £86,000.

We can advise on the impact of the Levy and what the costs cap will mean for you.

Dividend tax increases

As part of the funding plan for health and social care, dividend tax rates are similarly increased by 1.25% from 6 April 2022.

Anyone who operates their business through a personal or family company and extracts profits in the form of a small salary plus dividends will typically pay little or no National Insurance. As the Health and Social Care Levy is linked to National Insurance contributions, where this low salary strategy is adopted, they will either not pay the levy or pay it at a low rate. To address this and to ensure those operating through a personal or family company contribute towards health and social care costs, dividend tax rates are increased by the amount of the levy.

From 6 April 2022, the ordinary dividend tax rate will be 8.75% (currently 7.5%), the upper dividend tax rate will be 33.75% (currently 32.5%) and the higher dividend tax rate will be 39.35% (currently 38.1%).

The increase in the dividend tax rates will also impact on your profit extraction strategy. As the increase does not come into effect until 6 April 2022, it may be useful to review your dividend policy for 2021/22 to decide whether it is worth taking more dividends in 2021/22 to take advantage of the current, lower, rates. Whether this is beneficial will depend on your personal circumstances. We can help you decide.

The increases in the dividend tax rates will also affect you if you receive dividends from investments in shares.

Increase in the minimum pension age

The normal minimum pension age (NMPA) is the age at which most pension savers can access their pensions without incurring an unauthorised pension tax charge (unless they take their pension earlier due to ill-health). Registered pension schemes cannot normally pay benefits to members until they reach the NMPA (except in the case of ill-health).

The NMPA is to increase from 55 to 57 from 6 April 2028.

The change will affect you if you were born on or after 6 April 1973. If affected, you will need to wait until age 57 to access pension benefits without suffering an unauthorised payments charge (unless the scheme has a protected pension age). This will need to be considered in your ongoing retirement planning.

If you were co-ordinating your business exit planning with your 55th birthday, this will also need to be rescheduled.

Contact us to discuss what this change may mean for you.

Longer payment and reporting window for residential capital gains

If you sell a property that has not been your main residence throughout the period that you have owned it, for example, an investment property or a second home, you will have to pay capital gains tax if the chargeable gain exceeds your available annual exempt amount. The tax is payable at the residential rates of 18% where income and gains fall within the basic rate limit and at 28% once this has been used up.

The time limit for reporting residential capital gains and making a payment on account of the tax due is increased from 30 days to 60 days from Budget Day (27 October 2021).

If you have recently disposed of a residential property which has not been your main home throughout, we can help you.

Impact on your business taxes or finance

Extension of the AIA temporary limit

The Annual Investment Allowance (AIA) is a capital allowance that allows unincorporated businesses and companies to claim a deduction of 100% of the qualifying expenditure up to the amount of the annual limit. The AIA limit was temporarily increased from its permanent level of £200,000 to £1 million on 1 January 2019. Following an extension of one year, it was due to return to its permanent level of £200,000 from 1 January 2022.

However, the Chancellor has announced a further extension of the temporary limit, and the AIA will remain at £1 million until 31 March 2023. This removes the pressure to undertake capital expenditure by 31 December 2021 to benefit from higher limit.

Super-deductions

Companies can also benefit from a super-deduction of 130% of the amount of any expenditure that would otherwise qualify for main rate writing down allowances at 18% where the expenditure is incurred between 1 April 2021 and 31 March 2023. This is a better option for companies than the AIA.

Companies can also benefit from a 50% first-year allowance for expenditure within the same window that would otherwise qualify for a special rate writing down allowance of 6%. The AIA will trump the first-year allowance, but once the AIA limit has been used, it could be worthwhile claiming a first-year allowance.

We can help you plan your capital expenditure to optimise your capital allowances claims.

Business rates

Changes were announced in respect of business rates.

The business rates multipliers are frozen for a second year until 31 March 2023. The small business multiplier is set at 49.9p and the standard multiplier at 51.2p. Different rates apply in London and in Wales. The freezing of the multipliers will mean that your business rates will not increase in 2022/23.

Eligible retail, hospitality and leisure properties will benefit from a 50% relief in their business rates for 2022/23, subject to a cap of £110,000 per business.

A relief is also being introduced for improvements to business properties which will delay the start date of higher business rates triggered by the improvements for 12 months. The Government are to consult on how to implement the relief, which will take effect from 2023 and will be reviewed in 2028. If you are planning improvements to your business premises, this may benefit you.

From 1 April 2023 until 31 March 2035, a targeted business rates exemption will apply for eligible plant and machinery used in onsite renewable energy generation and storage, and a 100% relief will be available for eligible heat networks. This is to support the decarbonisation of non-domestic buildings.

From 2023, business rate revaluations will take place every three years rather than every five years.

Transitional relief for small and medium-sized businesses is extended for one year, which will restrict bill increases to 15% for small properties (i.e., those with a rateable value of up to £20,000 or up to £28,000 in Greater London), and to 25% for medium properties (i.e., those with a rateable value of up to £100,000).

Recovery loan scheme

The recovery loan scheme, which was due to end on 31 December 2021, has been extended by six months and will now run until 30 June 2022. If you need funding to help you recover from the impact of the pandemic, speak to us to see if this will be the right type of funding for you.

Freeport sites announced

Freeport tax sites benefit from a range of tax incentives to encourage businesses to operate from a Freeport Tax Site. The first tax sites will be in sited in Humber, Teesside, and Thames. If you are planning to start a new business or relocate to any of these sites, we can explain the tax advantages that may be available to you.

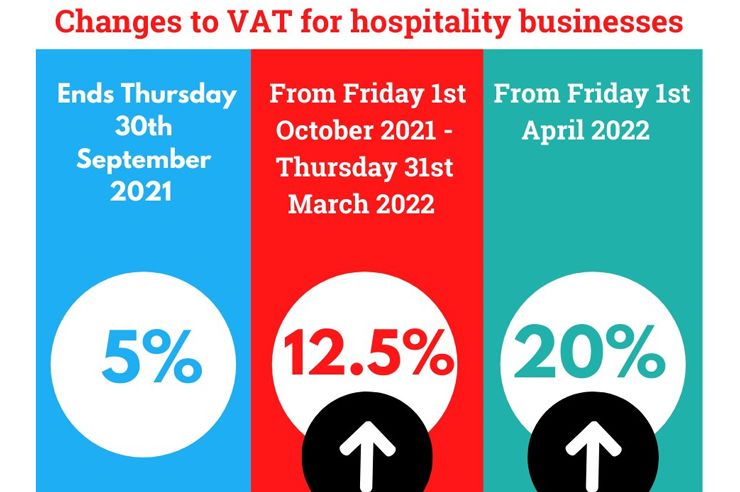

Making Tax Digital

The next key date in the Making Tax Digital (MTD) calendar is 1 April 2022. VAT registered business with turnover below the VAT registration threshold of £85,000, who have not joined MTD for VAT voluntarily, will be required to join from the start of their first VAT accounting period which begins on or after 1 April 2022. If you fall into this category, we can help you get ready for this change which will involve maintaining suitable digital records and submit digital VAT returns in an appropriate format.

As previously announced, the start date for MTD for Income Tax Self-Assessment (ITSA) has been put back by one year. It will now apply to sole traders and landlords with income of more than £10,000 from 6 April 2024. This will involve the submission of quarterly digital reports, and an end of period statement and final declaration.

However, MTD for ITSA will not apply to general partnerships (i.e., those without corporate partners) until 6 April 2025. A later, as yet unspecified start date applies to other partnerships (i.e., those with corporate partners or LLPS). It is therefore possible to push MTD ITSA further into the future by entering into a qualifying partnership arrangement.

We can help you understand what MTD for ITSA means for you, and when you will need to comply.

Basis period reform

To pave the way for the introduction of MTD for ITSA, the basis period rules are to be reformed for self-employed traders.

Currently, the profits that are assessed for a tax year are those for the accounting period ending in that tax year. For example, if you prepare accounts to 31 December, the profits for the year to 31 December 2021 are assessed in 2021/22.

However, this is all to change and the profits that will be assessed in the tax year will be those for the tax year (i.e., profits from 6 April to 5 April or, where preferred, 1 April to 31 March). As with MTD for ITSA, these reforms have been delayed by one year. A tax year basis period will apply from 6 April 2024, with 2023/24 being a transitional year.

If you do not currently prepare accounts to 31 March (or 5 April), you may want to consider changing your accounting date. We can explain how the rules will work, and how the transitional year changes will affect you.

If you have any questions regarding the budget then email us office@wfrancisandco.co.uk or call us on 01242 370298.